For far too long, a significant portion of the Malaysian population has been either uninsured or underinsured. Conventional insurance models often struggled to connect with these communities, creating a substantial gap in financial protection.

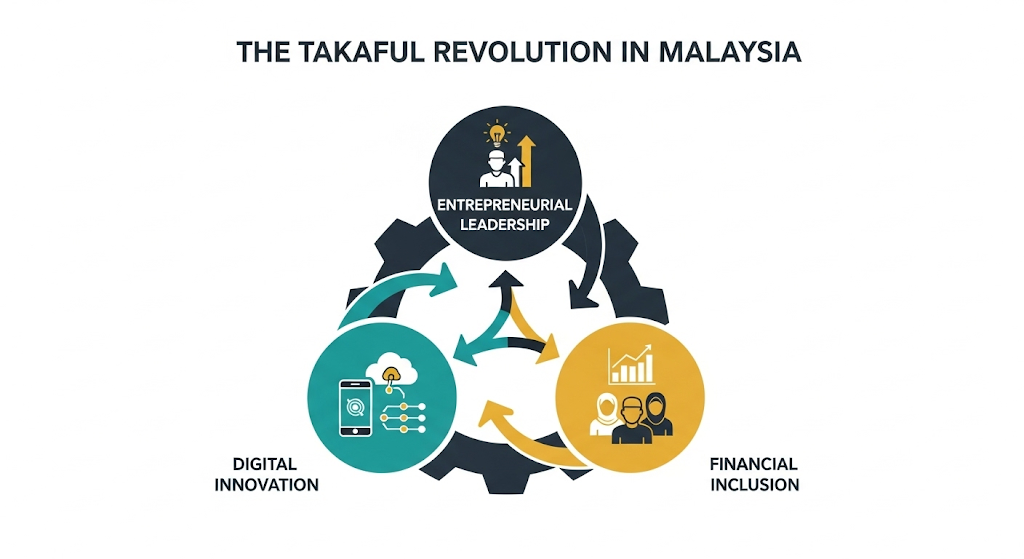

Enter Takaful, a system rooted in mutual assistance and shared responsibility. Once seen as a niche product, it is now at the forefront of a movement, driven by visionary entrepreneurial leaders who are fundamentally reshaping the entire insurance landscape.

A New Business Philosophy

This isn’t just about offering Shariah-compliant products. It’s about a fundamental shift in business philosophy. Instead of just focusing on profit margins, these Takaful leaders are building companies that prioritize financial inclusion using a people-first approach. They understand that true market leadership is about a company’s positive impact on society. By making insurance accessible, affordable, and easy to understand, they are not only protecting more families and businesses but also empowering a new generation of entrepreneurs.

The Power of Digital Innovation

One of the most significant changes is the embrace of digital innovation. Leaders in the Takaful space are moving beyond traditional agent-based models.

They’re pioneering user-friendly digital platforms that simplify the entire process, from getting a quote to filing a claim. This approach lowers operating costs and, more importantly, breaks down barriers for individuals who might not have easy access to a physical branch or an insurance agent. The result is a more dynamic and competitive market that benefits consumers directly.

A Global Hub for Islamic Finance

The rise of Takaful in Malaysia is a powerful testament to the country’s unique position as a global hub for Islamic finance. This homegrown success story is not only attracting domestic talent but also drawing international attention. New leaders are stepping up, bringing fresh perspectives and a relentless drive for innovation. Their focus extends to creating specialized products for micro-enterprises and low-income groups, segments of the economy that have traditionally been neglected. These tailored solutions offer a vital safety net for the sustainability and growth of small businesses.

Ultimately, the story of Takaful’s growth is one of proactive leadership. These entrepreneurs aren’t just reacting to market demands; they’re actively creating a more inclusive and resilient financial ecosystem. Their success proves that doing good for the community and achieving significant business success are not mutually exclusive goals. They are building a new standard for what it means to be a leader in the insurance world, setting a precedent that others will undoubtedly follow.